Product family

Listed derivatives are grouped into product families based on the underlying asset in each case. The same fee schedules apply to all products in a family. Volumes for all contracts are added up for the purposes of calculating reductions based on volume.

Risk factor calculation

Each product family has a specific risk factor table based on contract duration. Risk factors are calculated differently for outrights and structured products.

Outright products

Risk factors for outrights are defined on the basis of duration in terms of the number of months between the trade date and contract expiration, as illustrated in the following table.

In the case of DAP, if the trade date is before the 15th of the month, duration is the number of months between the trade date and contract expiration plus the month in which the trade takes place (+1). If the trade date is the 15th or later, duration is defined as for outrights.

Structured products

Risk factors for structured products are calculated as the difference between the risk factor for the long leg (the later expiration date) and the risk factor for the short leg (the earlier expiration date).

If the risk factor for the long leg is equal to the risk factor for the short leg, the risk factor to be considered for the short leg is the risk factor for the number of months to expiration.

Monthly ADV calculation

Monthly ADV is calculated each month for each investor considering all accounts with the same taxpayer ID (CPF, CNPJ, or third block of CVM code) in all brokerage houses. Volumes for all accounts linked to the same master account are added up and stated in the associated master document, regardless of the investor.

ADV is the sum total of all contracts in the same family traded (outrights and structured products bought and sold, whether or not in day trades, adjusted by risk factor) between the first and last business days of the previous month divided by the number of trading sessions in that month, and rounded to zero decimal places.

Where:

ADVf = ADV for product family f;

j = index that denotes each of the outright products in the same family;

k = index that denotes each of the structured products in the same family;

Qoutright j = quantity of outright product j traded;

Qestruturado k = quantity of structured product k traded;

RFj = risk factor for outright product j;

RFsl k = risk factor for the short leg (sl) of structured product k;

RFll k = risk factor for the long leg (ll) of structured product k;

Reduction for ADV calculation

The fee reduction for ADV specific to each product family is calculated monthly and valid for the entire trading month. It is based on the monthly ADV.

| Progressive table | |||

|---|---|---|---|

| Floor | Cap | Tier value | Additional value |

| D1 | U1 | V1 | A1 |

| D2 | U2 | V2 | A2 |

| D3 | U3 | V3 | A3 |

| ... | ... | ... | ... |

| Di-1 | Ui-1 | Vi-1 | Ai-1 |

| Di | Ui | Vi | Ai |

| Dn | Un | Vn | An |

The calculation is progressive: values are weighted by the total for each tier in compliance with the limit for the number of contracts per tier.

The additional value is merely a mathematical mechanism to calculate the progressive reduction:

The result of the calculation of the reduction is rounded to two decimal places.

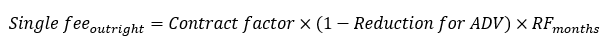

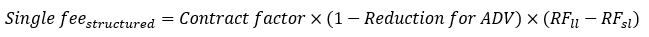

Single fee

The single fee is calculated by multiplying together risk factor, contract factor and reduction for ADV. The contract factor is a fixed value set for each product in a family, whether outright or structured. The result is rounded in two decimal places.

Outirght products

Where:

RFmonths = risk factor for a contract that expires on a given month

Structured products

Where:

RFsl = risk factor for the short leg (sl) of the structured product;

RFll = risk factor for the long leg (ll) of the structured product.

Translating foreign currencies

The single fee in a foreign currency is translated into BRL at the PTAX offer rate for the last day of the previous month and rounded to two decimal places.

Day trade reduction

Fees payable on day trades involving outrights and structured products are reduced by a percentage applied directly to the single fee calculated as shown above. The result of this multiplication is rounded to two decimal places.

Exchange fee and registration fee

The exchange fee and registration fee shall be defined by apportionment of the single fee charged to the investor (after application of the factors and reductions, if applicable). The exchange fees are calculated from the application of a percentage of the apportionment on the single fee, rounded off to two decimal places. The registration fee will be calculated as the difference between the single fee and the exchange fees.

The value of the apportionment is 35%.

Exchange fee

The unit cost value of the exchange fee, multiplied by the number of contracts for each executed transaction, rounded off to two decimal places.

Registration fee

The unit cost value of the registration fee, multiplied by the number of contracts in each executed transaction, rounded off to two decimal places.

If the single fee value is BRL0.01, this value will be charged on the registration fee. If the value is more than BRL0.01, both the exchange fees and the registration fee will have a BRL0.01 minimum, regardless of the apportionment.

The values obtained for the exchange fees and registration fee are applied on a per transaction basis.

Settlement fee

The settlement fee is payable on all contracts involving both outrights and legs of structured products when positions are closed out at expiration.

The settlement fee is a fixed amount per contract, which is multiplied by the number of contracts settled.

Permanence fee

Calculated per contract, in accordance with values established in the price tables. Its calculation basis is the number of open interest futures contracts on the previous day and represents the sum of all open interest in the same commodity and in the same market, regardless of the contract month, per account. The calculation period is the last business day of the antepenultimate month to the current one. It is calculated daily and charged as follows.

- Last business day of each month: the debit on this date will correspond to the accumulation of all the values of the permanence fee calculated on the days between the last charge and the previous business day.

- On the day following the closeout of all the positions in the same commodity of the same customer (account). In this way, the fee is debited on days between the last charge and the previous business day, exclusively for the commodity whose position was closed out.

- When there is full transfer of the positions of the customer (account) in the same commodity to another participant.

Where:

p = daily value of the permanence fee;

CAt-1 = sum of the quantity of open interest constracts on the previous day (t-1);

λ = reduction factor;

Ct + Vt = sum of the traded contracts (buy and sell, not netting) on date t;

Rounded off to the second decimal place.

For contracts with permanence fee in other currencies or commodities contracts, operated by 2687 investors (non-resident investores with CVM document), the permanence fee will be converted to BRL by the Exchange Rate from the last business day of the previous month, rounded in three decimal places.

Permanence Fee for DI1 Futures Contracts

The fee is calculated per investor, per maturity, as follows:

Where:

R = additional reduction factor, as a percentage, based on the opposite (offsetting) positions of DI1 Futures held in different accounts

- of the same maturity;

- of the same investor;

- of the same carrying broker (carrying broker).

The additional reduction factor (R) is calculated by applying a 50% reduction to the proportion of cleared contracts:

The quantity of cleared contracts is calculated for each maturity, in terms of the minimum amounts of the sums of long and short open positions in all accounts for the same investor and settlement participant:

Where:

CA = Open cleared contracts;

CAct-1 = quantity of open contracts bought on the previous day;

Cavt-1 = quantity of open contracts sold on the previous day;

l = quantity of accounts for each investor;

j = quantity of different maturities.

The new daily valur for the permanence fee (p) is rounded in five decimal places.