The new system architecture was necessary to solve two very critical situations for the participants:

access to the trading system of all investors through more than one gateway without account allocation restrictions; and

centralization of limits administration.

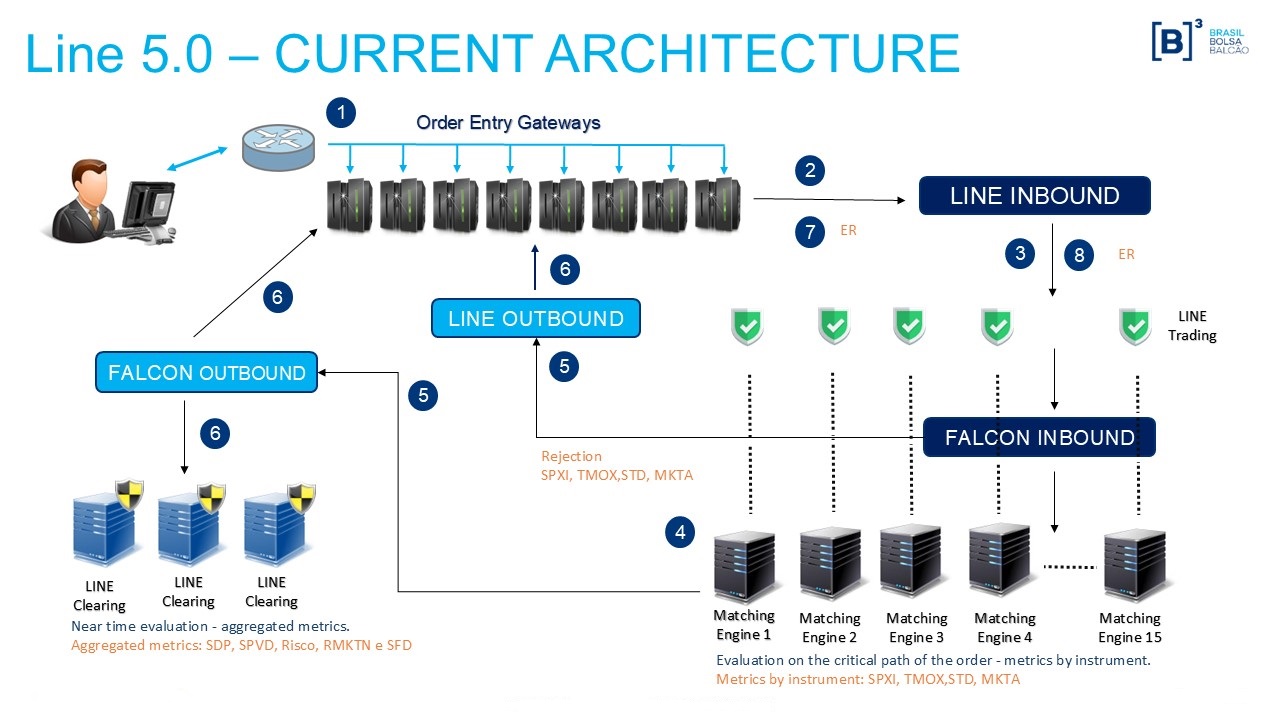

To make this possible, a component called Risk Center was created outside the order entry gateway, a component that centralizes the entire client flow allocated to the participant and evaluates the limits to then authorize the sending of the order to the trading center. The drawing below illustrates the system architecture.

The architecture also provides for communication between the portal and the risk centers and between them and the gateways, if necessary.

Architecture

- Superintendência de Suporte à Negociação (SSN)

- +55 11 2565-5000 opção 2

- [email protected]