Presentation

Since it’s creation in 2010, B3’s Carbon Efficient Index (ICO2 B3), was intended to be an instrument to induce the debate of climate change in Brazil.

Objective

The adhesion of issuers to ICO2 B3 demonstrates the commitment to their efficiency in the emission of Greenhouse Gases (GHG) and in the adoption of management practices that lead to greater efficiency in these emissions, contributing to the advancement of the transition to a low-carbon economy.

Eligible assets

From 2010 to 2019, companies that were part of the IBrX 50 were invited to participate in the process. From 2020 onwards, in a process of reviewing the methodology, considering global trends and movements on the subject, B3 started to invite companies from the IBrX 100, for the composition of portfolios from 2021 onwards. From January 2025, assets that are part of the Brasil Amplo Index (IBrA B3) portfolio will be eligible.

ICO2 B3 is made up of shares and units exclusively from companies listed on B3 that meet the inclusion criteria described in the methodology.

This universe does not include BDRs and assets of companies undergoing judicial or extrajudicial recovery, special temporary administration regime, intervention or that are traded in any other special listing situation (Concepts and Practices Manual for B3 Indices).

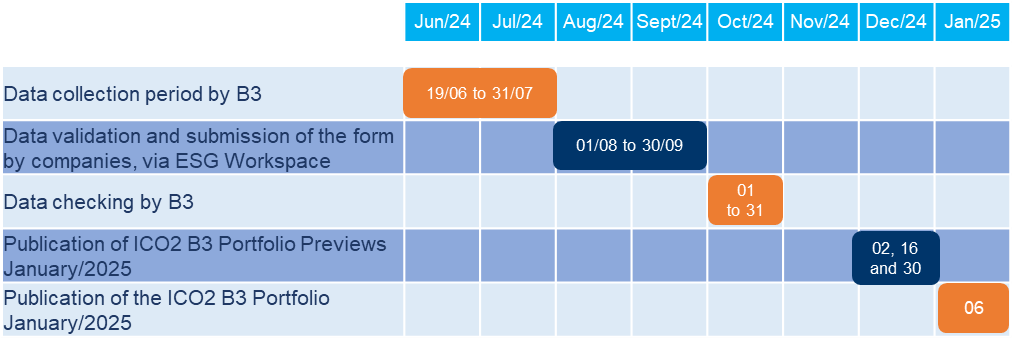

Calendar for listed companies – Process 2024/2025

For more information contact [email protected]