Collateral

- Home

- Products and Services

- Clearing and Settlement

- Clearing

- Risk management

- Collateral

- Collateral Offshore

- Margin Requirements and Collateral Deposits

As a central counterparty for the derivatives market, Clearinghouse requires collateral to be pledge by its participants as a mean to protect itself from the risk associated with their transactions. Should a participant default, the Clearinghouse will be responsible for the settlement of its trades, however, it can use the participant´s pledged collateral to compensate for any such losses that may occur.

Collateral margin is defined by the risk for the closeout of a portfolio faced by the clearinghouse.In order to calculate the risk for the closeout of a portfolio consisting of positions and collateral from several markets and asset classes, B3 developed an innovative risk measure: Close-Out Risk Evaluation (CORE).

Key CORE benefits:

- It calculates the worst accumulated cash flow during the portfolio closeout process

- It calculates the joint risk for positions and collateral

- It models three types of risk: market, liquidity for positions and collateral, and cash flow

- Accurate closeout strategy: position closeout transactions and collateral execution

- Severe loss (stress test): confidence level of 99.96% or 10Y crisis

- It considers 10,000 scenarios: historical (since 2002), quantitative and prospective

- Multi-horizon: daily closeout operations (1 to 10 days)

- It apllies full valuation

As Brazil is a final beneficiary owner model, B3 collateral management system accounts are segregated by each beneficiary owner in specific Custody Accounts. The system updates investor positions on a real-time basis.

- Posting Collateral Abroad to 4373 Nonresident Investors

The CMN Resolution #4569 authorizes nonresident investors to post collateral abroad for the transactions in the Brazilian financial and capital markets carried out within the scope of the clearinghouses and clearing and settlement service providers authorized by the Central Bank of Brazil (BCB).

In BCB Resolution #304/2023, BCB established that clearinghouses and clearing and settlement service providers may accept the posting of collateral abroad from non-resident investors, provided that their total amount, including the haircuts, does not exceed 8% (eight percent) of the total collateral required by the settlement system.

The nonresident investors domiciled in the United States of America, United Kingdom, Netherlands, France, Luxembourg and Cayman Islands, are allowed to post collateral abroad in accordance with the B3 Clearinghouse Risk Management Manual. Such investors must use B3’s accounts with DTCC (The Depository Trust & Clearing Corporation), Euroclear, Citibank or J.P. Morgan, depending on the collateral that will be posted. The following assets are accepted:- U.S. dollars [Citibank only]

- Euro [J.P Morgan only]

- U.S Treasury bonds [DTCC and Euroclear only]

- ADRs representing stocks eligible to be accepted as collateral [DTCC and Euroclear only]

- German Treasury bonds [Euroclear only]

- French Treasury bonds [Euroclear only]

- Dutch Treasury bonds; [Euroclear only]

- Canadian Treasury bonds [Euroclear only]

- Mexican Treasury bonds [Euroclear only]

In the case of Euro, it may be posted as collateral only by nonresident investors domiciled in the United States of America, United Kingdom, and Netherlands.

Nonresident investors who intend to post collateral abroad must send their supplementary registration information, through their Brazilian broker, to B3 Participant Registration Center. The investors who have been duly registered may request to B3, through the relevant broker, a request for limit reservation for the post of collateral abroad.

In compliance with BCB Resolution #304/2023, the Circular Letter 108/2024-PRE, establishes the operation for posting collateral abroad in favor of the B3 Clearinghouse by nonresident investors.

The valuation of collateral posted abroad is calculated and updated in accordance with CORE methodology, as described in B3 Clearinghouse Risk Management Manual.

Detailed information about B3’s account at DTCC:

B3’s account in DTCC = 0822

To transfer securities held in any other account at the Fed to the DTC’s Fed account on any business day, the Fed securities movement must always be made by 3:15 p.m. (New York time) through the Federal Reserve book-entry securities transfer system. Here is how to instruct the movement from their Fed account to DTC's account at the FRBNY.

DTC's ABA#: 026002066

DTC's Name: DTC SDFS

Receiving Account: CUST

Receiving Bank Info: FDO/participant number (Note: this would be the participant that will submit the pledge, not B3)

Cash Value: 0.00

Par Amount: The quantity of securities to be transferredDetailed information about B3‘s account at Euroclear:

B3’s account in EUROCLEAR for NON US investors = 17957

B3’s account in EUROCLEAR for US investors = 25393

To transfer securities held in any other account at the Fed to the Euroclear’s Fed account on any business day, the Fed securities movement must always be made by 07:00 pm Brussels time. Here is how to instruct the movement from their Fed and DTC account to Euroclear's account at the JP Morgan Chase.

Fedwire Format (free of payment) for US investors:Fed Account : 021000021 / EURCLR

SPC INS: G23019 EURO25393

DTCYID: 1970Fedwire Format (free of payment) for NON US investors:

DTC Format (free of payment) for Non US investors:

Fed Account : 021000021 / EURCLR

SPC INS: G23019 EURO17957

DTCYID: 1970

DTC Format (free of payment) for US investors:

DTC account: 1970

SPC INS: G21691 EURO25393

Agent Bank: 01970

Institution Number: 00026097

DTC account: 1970

SPC INS: G21691 EURO17957

Agent Bank: 01970

Institution Number: 00026097Procedure to post U.S. Treasuries, ADRs and German, French, Dutch, Mexican and Canadian Bonds as collateral:

-

The investor chooses to post collateral to B3 at either Euroclear or DTCC;

- The investor asks its Brazilian broker to apply to B3 a limit reservation request for the client to be allowed to post collateral abroad;

- B3 authorizes collateral to be posted abroad by the relevant nonresident investor upon verification of the limit availability;

- The investor specifies collateral information to his broker, submitting details including ISIN or CUSIP securities ID, amount, maturity, trade date, settlement date and the counterparty account number;

- In turn, the Broker requests the post of collateral by sending instructions to B3 (register collateral posting request at collateral management system - NGA);

- The investor instructs its custodian bank to deliver the securities to B3’s account at Euroclear or DTCC;

- At DTCC, B3 will be automatically notified when the investor´s collateral is transferred to its pledgee account;

- At Euroclear, B3 instructs it to receive (free of payment) the securities;

- When the transfer is settled, B3 collateral management system considers the securities as collateral.

Events: B3 do not authorizes to post as collateral assets that will have coupon payment or that has the maturity date in next ten working days counting from the record date. For the collateral posted, B3 will request to substitute or withdraw ten working days before the coupon payment or the maturity date counting from the record date.

Costs: The costs to B3 charged by DTCC and Euroclear for the custody of assets are proportionally shared by B3’s brokers who request this service and who may transfer these costs to the investor.

For movements of securities posted directly at Indeval with local settlement, use the following instructions in the SWIFT message:

- In favor of Euroclear's BIC Code "MGTCBEBE" in the "agent field".

- Citing Euroclear's local account at Indeval being "030370102" in the "safekeeping field of the agent";

- In the name of Euroclear's BIC Code "MGTCBEBE" in the "buyer field".

For movements of securities deposited at Royal Bank of Canada with local settlement, use the following instructions in the SWIFT message:

- In favor of Euroclear's agent at Royal Bank of Canada, with CUID RBCU or BIC Code ROYCCAT2ECL;

- Citing BIC MGTCBEBEECL in the "buyer field" and "safekeeping field";

- In the name of Euroclear's account at Royal Bank of Canada: 090002450007.

Further information at: http://www.dtcc.com/ and http://www.euroclear.com

Procedure to post U.S. Dollars as collateral:

- The investor requests to its Brazilian broker the post of dollars as collateral;

- The investor asks its Brazilian broker to apply to B3 a limit reservation request for the client to be allowed to post collateral abroad;

- B3 authorizes collateral to be posted abroad by the relevant nonresident investor upon verification of the limit availability;

- The broker requests to B3 the post of dollars as collateral (register collateral posting request at collateral management system - NGA);

- The investor transfers the dollars to B3’s cash account with Citibank

- As soon as Citibank confirms the post, B3 considers it as collateral;

- The broker is notified by the collateral management system;

Remuneration: collateral in currency are not remunerated for any reason.

Procedure to post Euros as collateral:

- The investor requests to its Brazilian broker the post of euros as collateral;

- The investor asks its Brazilian broker to apply to B3 a limit reservation request for the client to be allowed to post collateral abroad;

- B3 authorizes collateral to be posted abroad by the relevant nonresident investor upon verification of the limit availability;

- The broker requests to B3 the post of euros as collateral (register collateral posting request at collateral management system - NGA);

- The investor transfers the euros to B3’s cash account with J.P Morgan;

- As soon as J.P Morgan confirms the post, B3 considers it as collateral;

- The broker is notified by the collateral management system;

Remuneration: collateral in currency are not remunerated for any reason.

- Posting Collateral Abroad to 2687 Nonresident Investors

The CMN Resolution #2687 authorizes nonresident investors that only trade agricultural commodities to have some conveniences in terms of settling their transactions and posting collateral abroad.

Customers who are nonresident investors, pursuant to CMN Resolution #2687, settle in U.S. Dollars their transactions carried out in B3 agricultural markets and post U.S. Treasuries and U.S. Dollars as collateral of their transactions, which represent the only assets acceptable to constitute collateral by said investors.

Eligible assets accepted as collateral:

- U.S. dollars

- U.S. Treasury bonds

Detailed information about B3‘s Citibank account for posting collateral:

B3’s cash account in Citibank = 40804863

B3’s securities account in Citibank = 093380

Chips = 0008

ABA = 021000089

Swift = CITIUS33Detailed information about B3‘s account for variation margin settlement:

B3's cash account in Citibank for variation margin = 40804898

Procedure to post U.S. Dollars as collateral:

- The investor requests to its Brazilian broker the post of dollars as collateral;

- The broker requests to B3 the post of dollars as collateral (register collateral posting requestat collateral management system - NGA);

- The investor transfers the dollars to B3’s cash account with Citibank;

- As soon as Citibank confirms the post, B3 considers it as collateral; and

- The broker is notified by the collateral management system.

Procedure to post U.S. Treasuries as collateral:

- The investor will post collateral at B3’s Citibank account;

- The investor specifies the intended collateral to his broker, submitting details including, ISIN or CUSIP securities ID, amount, maturity, trade date, settlement date and the counterparty account number;

- In turn, the Broker requests the post of collateral by sending instructions to B3 (request the pledge at collateral management system - NGA);

- The investor instructs its custodian bank to deliver the securities to B3’s Citibank account;

- B3 instructs Citibank to receive (free of payment) the securities; and

- When the transfer is settled, B3 collateral management system considers the securities as collateral

- Calculation of the fee related to the custody collateral posted abroad - Euroclear

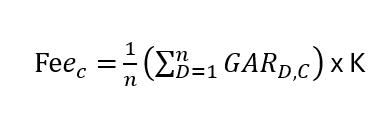

The fee related to the custody of collateral posted abroad is charged monthly by Euroclear, and proportionally shared by B3 among the participants who use this service. The fee is calculated according to the following methodology and posted to the multilateral net balance of each investor on the last business day of the month:

Where:

: fee charged for each investor C via Multilateral net balance on the last business day of the month.

: fee charged for each investor C via Multilateral net balance on the last business day of the month. : Total of Collateral deposited in Euroclear on the d-th business day by investor C, in R$

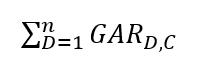

: Total of Collateral deposited in Euroclear on the d-th business day by investor C, in R$ : Sum of the daily value of the collateral

: Sum of the daily value of the collateral  deposited in Euroclear by investor ( C) over all business days of the mont, in R$

deposited in Euroclear by investor ( C) over all business days of the mont, in R$K: Factor determined by B3, representing the percentage cost of Euroclear.

B3 S.A. - Brasil, Bolsa, Balcão is a recognised third-country CCP in the United Kingdom. Neither B3 S.A., nor members of its group, are a recognised overseas investment exchange in the United Kingdom, nor are they an authorised person in the United Kingdom. As a result, the material on this website are for distribution only to (and should be used and read only by) persons who (i) have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the "Financial Promotion Order"), (ii) are persons falling within Article 49(2)(a) to (d) ("high net worth companies, unincorporated associations etc") of the Financial Promotion Order, (iii) are outside the United Kingdom, or (iv) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with the matters to which this website and its contents relate may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as "relevant persons"). This website and its content are directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this website and its contents relate are available only to relevant persons and will be engaged in only with relevant persons.